Legislation for overseas buyers/owners is changing

April 2nd, 2015

Legislation for overseas buyers/owners is changing as of 6th April 2015 and this could have significant implication to your investment property should you consider selling your property in the future. After the 6th April 2015 you will be liable for capital gains tax. Now is an opportunity to have a valuation of your property carried out thus meaning any increase in value from when the property was first purchased to 6th April 2015 will not be liable for capital gains tax, only the increase in value after this date.

Below is the detailed explanation of valuation.

Capital Gains Tax

From 6th April 2015 overseas residents will be exposed to Capital Gains Tax on the relevant amount of profit on disposal of their residential investment properties.

The amount of capital gain relating to the period prior to 5th April 2015 is not taxable, only the element corresponding to the subsequent period.

FACTS

• Capital Gains Tax will apply to all overseas investors including offshore structures

• Capital Gains Tax will only apply to gains made after 6th April 2015

• The tax rate ranges from 18-28% of the gain made after 6th April 2015

• Capital Gains Tax is payable within 30 days of sale of the property

• The gain can be calculated by apportionment of time or by way of a valuation as at 6th April 2015

• There is no set requirement for a particular type of valuation to be carried out although any valuation can be challenged by HMRC

OUR ADVICE

• Whether you are selling now or in the future we recommend having a valuation carried out at the earliest opportunity whilst market evidence is fresh, although a valuation can also be completed retrospectively when you decide to sell

• Capital Gains Tax can also be mitigated on investments that have exchanged and not yet completed including off plan purchases

• We would advise having a valuation carried out by a suitably qualified RICS professional as evidence of the value of your investment at 6th April 2015 as this would be expected to hold more weight with HMRC than an estate agency market appraisal

• We recommend speaking to your tax advisor regarding how best to mitigate your Capital Gains Tax liability and we can put you in touch with an advisor if required

Kate’s calculations to help you with your property project

February 2nd, 2015

What tenant fees will you have to pay before you can move in?

All agents and landlords MUST tell you in advance of any fees you have to pay to rent a property – if they don’t, they are not allowed to charge you.

Tenant fees vary, but typically they include an applicant fee, a second or third fee for more than one tenant. Some may charge a ‘couples fee’. If you have to have a guarantor that will incur another fee.

Other fees include referencing, contribution to the agreement and/or inventory, tenancy renewal fee.

If you have been accepted for a property you will have to pay 4-6 weeks rent in advance of moving in as a deposit and also pay the first month’s rent in advance.

Examples of good agents who are upfront about their fees include: Belvoir Lincoln; Savills; Your Move;Reeds Rains.

Are you paying more dead money in rent than through a mortgage?

Typically if you are renting a property and you pay £500 per month, your annual rent is £500 x 12 = £6,000. If the value of the property you live in is around £120,000 and you only have a 5% deposit and would pay for a 95% mortgage at a 5% rate, then you would be paying as much ‘dead money’ in mortgage interest as you would be to the landlord.

Easy calculation is if your rent is 5% or less than the value of the property you rent, then the dead money to landlords and to the mortgage company in interest is the same.

Calculating whether buying is cheaper than renting

In the main if prices are falling or are static, then it may well be cheaper to rent than buy. The costs for each are as follows, this assumes things like utility bills, council tax, service charges etc would be the same, so highlights the different costs:-

Renting – one off tenant/reference fee, monthly your rent, annually your contents insurance and renewals.

Buying – one off fees for buying and the deposit, monthly your mortgage, annually maintenance and buildings & contents insurance. Annually you may add in the increased or take away the fall in the property’s value.

Working out how on earth you can save £1000s towards a deposit

It will probably seem a daunting task to save £5000 – £15.000 for a deposit but it is possible.

Calculating the costs of buying a property

It can be very scary working out how much it will cost to buy a property and then when you have to pay the money to the lender, and legal company.

The biggest cost is likely to be your deposit which you pay at the time of exchange, so if you send a cheque to the legal company to exchange you will need to send it 5 working days BEFORE exchange.

Deposits are normally 5% or 10% at the time of exchange, then the balance eg 20 or 15% if you are depositing 25% is paid when you complete.

The second biggest cost is normally stamp duty - this is paid when you complete the purchase:-

The rates changed in December 2014. 0% up to £125,000; from £125,001 to £250,000 it’s 2% on the amount OVER £125,0000 up to £250,000; 5% on increments over£250,000 to £925,000; 10% for the amount paid from £925k to £1.5 million and anything over this amount you pay 12% on. Have a read about Stamp Duty changes and visit HMRC.

Lenders and brokers do charge for mortgages and these costs can add up. However they should only really charge you when you have decided it’s the mortgage YOU want.

Charges can be fixed and may be a few hundred pounds through to several thousand. They can also be charged as a percentage of the money you borrow, such as 1-3%. Make sure you know any fees you will be charged BEFORE you confirm you will go ahead with the mortgage.

When you exchange on a property you will need to have organised your buildings insurance, which will typically be a few hundred pounds. Read our Insurance Checklists to help organise the right cover for you.

Survey fees will range from £250 + VAT for a condition report to £400 + VAT for a Homebuyer Report to over £1,000 for a comprehensive building survey.

Legals will range from around £300 + VAT to over £1,000 + VAT for properties over £500,000. Extras you have to pay include legals for leasehold, shared ownership etc these are usually £100 +VAT.

Removal costs will be around £300 + VAT for a small move, through to £2,000 +VAT for moving a big house some distance. A great, cost effective service to always have is packing – it saves huge amounts of hassle!

Calculating the costs of selling a property

The key fees are the estate agent’s fees which will be 1% to 2% of the value of your home. So if it sells for £200,000 x 1.5% = £3,000. BUT bear in mind thanks to the government, this will increase by 20% VAT so you pay the agent £3,600 but they only get £3,000.

On-line agents will advertise your property, but not much else, typically on-line agents are around £500.

Finance fees may be charged if you are penalised for paying off your mortgage – it’s called a mortgage redemption fee. This could be £300 through to several thousand pounds.

Your legals will be around £300 + VAT upwards.

Removals fees

range from £300 + VAT to over £2,000 + VAT (see above on buying)

Buy to let calculations

There are lots of ways of calculating buy to let numbers. Here’s some ‘rules of thumb’

Gross Yield is calculated by taking the price paid for the property and dividing this by the income received.

So if you paid £100,000 for a property and the annual rent is £5,500, your gross yield is £5,000/£100,000 = 5.5%

Rule of thumb #1

If a property has a 5.5% yield; your mortgage rate is 5% and you borrowed 75% mortgage, then your net income before tax will be zero.

Rule of thumb #2

If a property has a yield of 6% or less, usually you secure good capital growth over 10-15 years, but don’t secure much income.

If a property has a yield of 7% or more, usually the income you receive is good, but capital growth is poor.

Brought to you by Kate Faulkner

To Move or Improve?

February 2nd, 2015

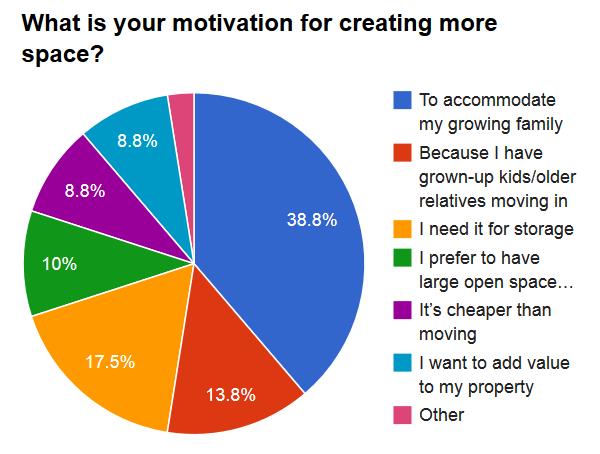

A OnePoll, on behalf of Ocean Finance, asked 2000 adults during November whether they fancied doing some home improvement on their property. The poll is good news for DIY retailers and tradesmen as it suggests 50% of homeowners intend to carry out a property project on their home in 2015. The most popular changes remain adding space via the likes of extensions and conversions. For many, this is a much better idea in this day and age than trying to move. This is partly as properties available for sale are in such short supply, so there is often little choice, and on the other hand, the costs, uncertainty and hassle of moving aren’t particularly enticing either! The research from OnePoll suggested that for every eight properties being improved, at least one is planned to be extended or converted. The main reason for doing this is the need for more space as the family grows. And interestingly, it’s not the ‘pitter patter of tiny feet’ that people need to increase the size of their home, much of it is because of returning relatives too. That might be kids who are coming home to save for a deposit for their own property, through to mum and dad coming back as they are struggling to live on their own. But it’s not just creating extra space that people are planning, according to the research classic updating home improvements are:-

-

Decorating – 25%

-

Fitting a new kitchen – 8%

-

New bathroom installed – 7%

What to watch out for when improving your home! If you are planning on home improvements this year, then do make sure you use quality tradesmen who are members of associations that offer guarantees, warranties and ideally, an independent third party complaints procedure. For more help check out our checklists:-

Should you move or improve? If you need more space, then it’s worth seeing if you can add it to your home first. But bear in mind, this may require planning permission and you will certainly need the changes to pass building control to convert or add any new space in the form of an extension. And that means employing experts who are likely to cost several thousand pounds. So depending on how much your home is worth, their costs could be as much as an estate agent would charge to sell your property. Secondly, even if you can increase the space, are you living where you want? Will the property deliver into the future as well? Adding space doesn’t always add value, and in some cases, can detract from the value if done badly or if there is a shortage of two bed properties in your area and you make yours a three bed or a three bed to a four bed. This is the case for the property I have. I originally bought it with the idea to take it from a four to a six bed home, but in my village, we have too many five and six bed homes and not enough smaller ones, so I ditched that idea as it would detract from the value.

Brought to you by Kate Faulkner

Why London homes remain affordable – it is the buyers who change

December 22nd, 2014

What has altered is not the housing but the backgrounds of the people who live there and their sources of wealth no one can afford to buy a house in London any more.” Once again, rising house prices are a topic of conversation at metropolitan dinner parties. Over the past 50 years, figures from the Halifax show Greater London house prices rising relative to those in the rest of the UK by a modest but cumulatively significant 0.5 per cent per year.

But people plainly can afford to buy houses in London. House prices can be high and rising if – and only if – people can afford to pay these prices. Some people who used to be able to afford central London house prices are now unable to do so, while others who used not to be able to afford them – or chose not to afford them – can now do so. If prices are rising, it is because the latter group outnumber the former. What has changed is not housing but the backgrounds of the people who live in these homes and their sources of wealth.

Carlton House Terrace is possibly the most desirable address in London. The street overlooks The Mall, the approach road to Buckingham Palace. A house in Carlton House Terrace is at present on the market with a reported asking price of £250m. If that price is achieved, the house would be the UK’s most expensive property. The current owner is thought to be a Middle Eastern prince.

Two doors away is the London residence of the Hinduja brothers, scions of the family-owned, Indian-based industrial and financial conglomerate. They have spent hundreds of millions of pounds on the most opulent of restorations. Most of the rest of the street is occupied by bodies which benefit from the favour of the freeholder, the Crown Estate. The British Academy and the Royal Society are on opposite sides of the steps leading down to The Mall. In a glorious, if incongruous, conjunction the Turf Club sits next to the Royal Society.

In the 19th century, all properties in the street were private residences. Some occupants were politicians – Lord Palmerston and William Gladstone both lived in Carlton House Terrace. So did Baron Stockmar, the shadowy counsellor to the young Queen Victoria. But the majority of residents were aristocrats whose names have faded into obscurity.

Democracy chose a different type of politician, and the power and wealth of the British aristocracy waned. In the 20th century Carlton House Terrace took on a more commercial tone. One resident was Weetman Pearson, 1st Viscount Cowdray, the architect of the Pearson Group – the company which today owns the Financial Times, but was then a global infrastructure business which built the rail tracks under New York’s East River. His neighbours included George Stephen, the Scots-Canadian financier of the Canadian Pacific Railway; Harry Gordon Selfridge, who established the eponymous department store; and Lord Revelstoke, of the Baring banking family. George Nathaniel Curzon, the grandest of India’s viceroys, returned from the subcontinent to become the terrace’s most superior resident, although he never accomplished his real property ambition – a move to 10 Downing Street.

A home in Carlton House Terrace is the ultimate “positional good”. This is a term coined by Fred Hirsch in an insightful work titled Social Limits to Growth (1976). Economic growth is associated with increased availability of most commodities, but for some the absolute supply is fixed. Beautiful landscapes, paintings by Rembrandt. Properties in Carlton House Terrace and other prize London locations such as Belgravia’s Eaton Square, Kensington’s Pelham Crescent, and Hampstead’s Bishops Avenue. The staff needed to service grand properties are also positional goods. The positional good is one which by its nature can only be available to a few people.

The price of positional goods will normally rise faster than incomes. People aim to spend more of their income on positional goods as they become richer, but only a few can ever realise these ambitions. So such goods will always held by the people who are at that time the richest, but who these people are may vary from time to time. The range of house prices – and the availability of servants – will reflect the underlying inequality of incomes. The price of prime property in central London will be a direct function of the levels of income and wealth of the most affluent people who want to live in London.

The story of subprime central London property is more complex. The invention of motorised transport in the 19th century made possible the development of large cities, with large populations. In 1801, 1m people lived in London: in 1901, there were 6.5m. The first underground railways allowed the geographical expansion of London’s inner core – the grand houses of Earls Court were a direct result. But the attractions of these houses proved shortlived. With the growth of a suburban rail network, a new word – commuter – entered the English language to describe the holder of a season ticket. The expansion of London continued as the transport network grew. In the 1950s, John Betjeman would celebrate “Metroland” – the developments to the northwest of the city made possible by the building of the Metropolitan Railway.

The street of terraced houses in which I live is considerably more modest than Carlton House Terrace but was built at about the same time, though for artisans and tradespeople rather than aristocrats and statesmen. The first occupant of my house was a carpenter who occupied the lower floors with his wife and family while their two servants huddled in attic rooms. But as the character of London changed to become a commuter city, this type of centrally located property entered a long and steady decline.

By the end of the 19th century, the house was in multiple occupation: a house painter and his family occupied the ground floor, with three rooms let to lodgers. When the architectural historian, Sir Nikolaus Pevsner surveyed London’s architecture in the 1950s, he would describe the area as slummy. But not for much longer. Expansion of London’s boundaries had reached its limits: a “greenbelt” constricted further expansion. The improvement in transport links came to an end; commuting to London is generally no easier or quicker today than in 1939. The supply of London houses was once more a fixed number, and London property as a whole – not just its trophy residences – became a positional good. The composition of employment in London was also changing. Manufacturing and wholesale distribution now suffered rather than benefited from a London location and moved out. For much of the postwar period, official policies encouraged that relocation. In their place, financial and business services expanded and clustered in the capital.

Another new word – gentrification – was invented to describe the resulting changes, as kitchen stoves gave way to Gaggenau appliances. The skips have long gone from my street – they have moved steadily outward from the centre, as Hackney and Stoke Newington take on a new identity as Islington East, and Kilburn becomes West Hampstead. Where gentrification has a longer history, you can identify successive layers of incomers, as on an archaeological site: most houses are occupied by people who could not now afford to buy them. Most residents now work in business services, but, in a further turn of the wheel of fortune, many of these people now struggle to afford property in central London; they are squeezed by those who acquire positions, or the money that goes with positions, from their parents. Thus, the historic rise in house prices aids the transmission of inequality through the generations. There is a certain irony in noting that now my most famous neighbour is the son of Tony Blair, the former UK prime minister.

In Carlton House Terrace, British politicians and aristocrats gave way to British businessmen and financiers. Briefly, at about the time of the second world war, reduced inequality diminished the attractions of these properties and limited the ability to find the staff to keep them going. But, as inequality again increased, and an improvement in international communications made world, rather than domestic, inequality relevant, these prime properties became havens for a global elite, and London the world’s most desirable – and hence the most cosmopolitan – city. The positional good of a prime London property became a universal aspiration. A terraced house in Marylebone was a positional good when it was built in the early 19th century, and 200 years later it would be a positional good again.

The monetary rewards attached to different occupations and social positions change from one period of history to another. The houses remain, the backgrounds of their occupants change. Central London houses are always affordable. The economic and political climate determine who can afford them at any particular point in time, and that in turn determines the social complexion of the capital.

The Institute of Physics will soon be our direct neighbours!

September 11th, 2014

The new building, located on Balfe Street is in amongst the exciting regeneration of the King’s Cross area & close to the new development that will include properties such as the Google building & already contains the offices of the Guardian, the Crick Centre & Macmillan publishers’ education & science campus. It is an expanding district of London that is undergoing significant regeneration & is seen as having enormous potential for growth.