Kate’s calculations to help you with your property project

February 2nd, 2015

What tenant fees will you have to pay before you can move in?

All agents and landlords MUST tell you in advance of any fees you have to pay to rent a property – if they don’t, they are not allowed to charge you.

Tenant fees vary, but typically they include an applicant fee, a second or third fee for more than one tenant. Some may charge a ‘couples fee’. If you have to have a guarantor that will incur another fee.

Other fees include referencing, contribution to the agreement and/or inventory, tenancy renewal fee.

If you have been accepted for a property you will have to pay 4-6 weeks rent in advance of moving in as a deposit and also pay the first month’s rent in advance.

Examples of good agents who are upfront about their fees include: Belvoir Lincoln; Savills; Your Move;Reeds Rains.

Are you paying more dead money in rent than through a mortgage?

Typically if you are renting a property and you pay £500 per month, your annual rent is £500 x 12 = £6,000. If the value of the property you live in is around £120,000 and you only have a 5% deposit and would pay for a 95% mortgage at a 5% rate, then you would be paying as much ‘dead money’ in mortgage interest as you would be to the landlord.

Easy calculation is if your rent is 5% or less than the value of the property you rent, then the dead money to landlords and to the mortgage company in interest is the same.

Calculating whether buying is cheaper than renting

In the main if prices are falling or are static, then it may well be cheaper to rent than buy. The costs for each are as follows, this assumes things like utility bills, council tax, service charges etc would be the same, so highlights the different costs:-

Renting – one off tenant/reference fee, monthly your rent, annually your contents insurance and renewals.

Buying – one off fees for buying and the deposit, monthly your mortgage, annually maintenance and buildings & contents insurance. Annually you may add in the increased or take away the fall in the property’s value.

Working out how on earth you can save £1000s towards a deposit

It will probably seem a daunting task to save £5000 – £15.000 for a deposit but it is possible.

Calculating the costs of buying a property

It can be very scary working out how much it will cost to buy a property and then when you have to pay the money to the lender, and legal company.

The biggest cost is likely to be your deposit which you pay at the time of exchange, so if you send a cheque to the legal company to exchange you will need to send it 5 working days BEFORE exchange.

Deposits are normally 5% or 10% at the time of exchange, then the balance eg 20 or 15% if you are depositing 25% is paid when you complete.

The second biggest cost is normally stamp duty - this is paid when you complete the purchase:-

The rates changed in December 2014. 0% up to £125,000; from £125,001 to £250,000 it’s 2% on the amount OVER £125,0000 up to £250,000; 5% on increments over£250,000 to £925,000; 10% for the amount paid from £925k to £1.5 million and anything over this amount you pay 12% on. Have a read about Stamp Duty changes and visit HMRC.

Lenders and brokers do charge for mortgages and these costs can add up. However they should only really charge you when you have decided it’s the mortgage YOU want.

Charges can be fixed and may be a few hundred pounds through to several thousand. They can also be charged as a percentage of the money you borrow, such as 1-3%. Make sure you know any fees you will be charged BEFORE you confirm you will go ahead with the mortgage.

When you exchange on a property you will need to have organised your buildings insurance, which will typically be a few hundred pounds. Read our Insurance Checklists to help organise the right cover for you.

Survey fees will range from £250 + VAT for a condition report to £400 + VAT for a Homebuyer Report to over £1,000 for a comprehensive building survey.

Legals will range from around £300 + VAT to over £1,000 + VAT for properties over £500,000. Extras you have to pay include legals for leasehold, shared ownership etc these are usually £100 +VAT.

Removal costs will be around £300 + VAT for a small move, through to £2,000 +VAT for moving a big house some distance. A great, cost effective service to always have is packing – it saves huge amounts of hassle!

Calculating the costs of selling a property

The key fees are the estate agent’s fees which will be 1% to 2% of the value of your home. So if it sells for £200,000 x 1.5% = £3,000. BUT bear in mind thanks to the government, this will increase by 20% VAT so you pay the agent £3,600 but they only get £3,000.

On-line agents will advertise your property, but not much else, typically on-line agents are around £500.

Finance fees may be charged if you are penalised for paying off your mortgage – it’s called a mortgage redemption fee. This could be £300 through to several thousand pounds.

Your legals will be around £300 + VAT upwards.

Removals fees

range from £300 + VAT to over £2,000 + VAT (see above on buying)

Buy to let calculations

There are lots of ways of calculating buy to let numbers. Here’s some ‘rules of thumb’

Gross Yield is calculated by taking the price paid for the property and dividing this by the income received.

So if you paid £100,000 for a property and the annual rent is £5,500, your gross yield is £5,000/£100,000 = 5.5%

Rule of thumb #1

If a property has a 5.5% yield; your mortgage rate is 5% and you borrowed 75% mortgage, then your net income before tax will be zero.

Rule of thumb #2

If a property has a yield of 6% or less, usually you secure good capital growth over 10-15 years, but don’t secure much income.

If a property has a yield of 7% or more, usually the income you receive is good, but capital growth is poor.

Brought to you by Kate Faulkner

To Move or Improve?

February 2nd, 2015

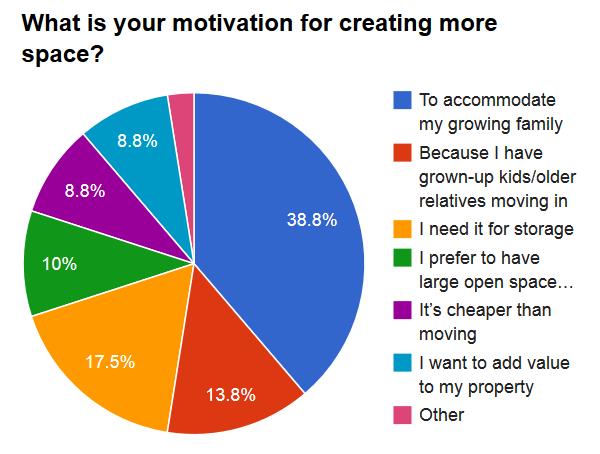

A OnePoll, on behalf of Ocean Finance, asked 2000 adults during November whether they fancied doing some home improvement on their property. The poll is good news for DIY retailers and tradesmen as it suggests 50% of homeowners intend to carry out a property project on their home in 2015. The most popular changes remain adding space via the likes of extensions and conversions. For many, this is a much better idea in this day and age than trying to move. This is partly as properties available for sale are in such short supply, so there is often little choice, and on the other hand, the costs, uncertainty and hassle of moving aren’t particularly enticing either! The research from OnePoll suggested that for every eight properties being improved, at least one is planned to be extended or converted. The main reason for doing this is the need for more space as the family grows. And interestingly, it’s not the ‘pitter patter of tiny feet’ that people need to increase the size of their home, much of it is because of returning relatives too. That might be kids who are coming home to save for a deposit for their own property, through to mum and dad coming back as they are struggling to live on their own. But it’s not just creating extra space that people are planning, according to the research classic updating home improvements are:-

-

Decorating – 25%

-

Fitting a new kitchen – 8%

-

New bathroom installed – 7%

What to watch out for when improving your home! If you are planning on home improvements this year, then do make sure you use quality tradesmen who are members of associations that offer guarantees, warranties and ideally, an independent third party complaints procedure. For more help check out our checklists:-

Should you move or improve? If you need more space, then it’s worth seeing if you can add it to your home first. But bear in mind, this may require planning permission and you will certainly need the changes to pass building control to convert or add any new space in the form of an extension. And that means employing experts who are likely to cost several thousand pounds. So depending on how much your home is worth, their costs could be as much as an estate agent would charge to sell your property. Secondly, even if you can increase the space, are you living where you want? Will the property deliver into the future as well? Adding space doesn’t always add value, and in some cases, can detract from the value if done badly or if there is a shortage of two bed properties in your area and you make yours a three bed or a three bed to a four bed. This is the case for the property I have. I originally bought it with the idea to take it from a four to a six bed home, but in my village, we have too many five and six bed homes and not enough smaller ones, so I ditched that idea as it would detract from the value.

Brought to you by Kate Faulkner

The Institute of Physics will soon be our direct neighbours!

September 11th, 2014

The new building, located on Balfe Street is in amongst the exciting regeneration of the King’s Cross area & close to the new development that will include properties such as the Google building & already contains the offices of the Guardian, the Crick Centre & Macmillan publishers’ education & science campus. It is an expanding district of London that is undergoing significant regeneration & is seen as having enormous potential for growth.